Why Fulcrum’s STARPower Clients Are Better Positioned To Reclaim What’s Rightfully Theirs

Why Fulcrum’s STARPower Clients Are Better Positioned To Reclaim What’s Rightfully Theirs

By Steve “The Doctor” Meek | Talk To Th3 Doc Podcast | Fulcrum Group

🎙 Podcast Doc-umentary

In Episode 108 of Talk To Th3 Doc, I sat down with Rob Bryant and Jeff Feingold of Tax Point Advisors to talk about R&D tax credits — those elusive government incentives that so many small and mid-sized businesses never realize they qualify for. And let me tell you, it was like discovering an unlocked treasure chest in the attic you’ve never bothered to look inside.

It reminded me of an old Bruce Lee quote I love: “Knowing is not enough, we must apply. Willing is not enough, we must do.” This episode hit home on both counts — you might be innovating right now without even knowing you’re leaving tax credit money on the table.

💰 R&D Tax Credits: Not Just for Tech Giants

Here’s what most SMBs get wrong: they think “R&D” means you’ve got to be in a white lab coat or building rockets. But as Rob and Jeff laid out, if you’re solving business problems with custom software, retooling internal workflows, or adapting a solution to fit your industry needs — you’re likely doing qualifying research and development.

And guess what? Many of the same projects we help our clients with under our STARPower innovation framework fall squarely into that category. These aren’t just IT upgrades. They’re custom business improvements, and they can be worth real money.

As Jeff put it, “This is a credit, not a deduction.” Meaning you could get cash back, not just a smaller tax bill.

🤝 Fulcrum’s STARPower: Built for Innovation ROI

Now this is where it all clicked for me — Fulcrum’s STARPower process already encourages clients to:

- Document and align strategic tech initiatives

- Measure process improvement outcomes

- Engage in quarterly business reviews

- Create a technology roadmap

- Tie tools to adoption and performance

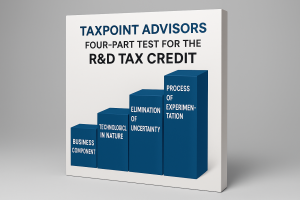

That’s the same kind of documentation and intent that Rob and Jeff said is needed to pass the “Four-Part Test” for R&D eligibility. We’re already doing the groundwork — we just needed to pair up with someone who can translate it into tax benefits.

Think of it like this: Fulcrum helps you build the engine. Tax Point Advisors helps you get reimbursed for the fuel.

🛡 Compliance Meets Cash Flow

Let’s not forget — these R&D rules aren’t just about opportunity. There’s risk if you’re unaware of recent Section 174 changes. Starting in 2022, you had to capitalize and amortize R&D costs over five years instead of deducting them all at once. That created a whole new compliance requirement most SMBs don’t even realize exists. However, the passage of the One Big Beautiful Bill Act (OBBBA)caused a reversal of R&D Amortization. A major change is the return to immediate expensing for domestic R&D costs, reversing the previous five-year amortization rule. This change is effective for tax years beginning after December 31, 2024 and a huge win for SMBs.

At Fulcrum, we already help our clients stay ahead of regulatory change — whether it’s cybersecurity frameworks like CIS v8, or IT standards around ITIL-based service management. We make compliance easier because we’ve already got the foundational process muscle.

If you’re already doing the work, why not get the benefit?

📉 Real Money Left on the Table

According to the National Association of Manufacturers, the average R&D tax credit claim for small businesses is between $30,000 and $60,000 per year. And yet, over 80% of SMBs never apply.

That’s like hitting every free throw in practice and never stepping up to the line during a game. (And yes, I do still try to sink free throws whenever I’m near a court.)

We see this all the time — SMBs with lean teams, working hard to get more from their tech investments, yet missing out on these big wins because no one ever told them to look in that direction.

🧠 From Reactive to Proactive — It’s the Fulcrum Way

Fulcrum Group has always believed in co-creating with our clients. We don’t just fix problems — we build roadmaps with you. We listen, document, align, and support innovation in a way that’s not just tactical, but transformational.

This podcast episode was a great reminder that how we do IT — intentionally, strategically, transparently — doesn’t just result in better business outcomes.

It can also lead to unexpected financial returns.

Whether it's building automation workflows in Microsoft 365, working with your software vendors to integrate apps, or assisting with AI projects, our SPOT Managed IT Services ensure that those efforts are captured, measured, and potentially… reimbursed.

✅ Fulcrum + Tax Credits: The Winning Play

Here’s how to know you’re a good candidate for the R&D credit:

- You’re using tech to solve operational challenges

- You’re building or customizing software (even internally)

- You’re tracking process improvements or new product features

- You’re working with Fulcrum and we’re documenting your STARPower initiatives

If that’s you — it’s time to see if Uncle Sam owes you a check.

📞 Your Next Step? Let’s Stack Value.

Don’t let complexity or assumptions stop you. If you’re already investing in innovation — through your IT, your people, or your operations — you deserve to explore the full return.

👉 Schedule a Fulcrum Strategy Review

👉 Get a Free R&D Eligibility Assessment with Tax Point Advisors

Let’s turn your technology plan into a performance engine — and make sure the IRS helps fund it.

🎧 Catch the Full Episode:

Unlock Hidden Tax Credits Most SMBs Miss – With Rob Bryant & Jeff Feingold (Ep. 108)

🎧 Spotify

🍏 Apple Podcasts

🎙️ Amazon Music

📱 Pocket Casts